tesla tax credit 2021 georgia

Manufacturers suggested retail price MSRP. 2021 Ford Mustang Mach-E SUV.

Latest On Tesla Ev Tax Credit March 2022

Costs associated with the active solar shingle portion of the roof qualify for the 26 solar tax credit.

. The tax credit for Tesla and General Motors vehicles has been phased out since 2021 due to. At just over 40000 the Ford Mustang Mach-E SUV isnt any cheaper than the base model Tesla Model 3 but it does come with one major selling point. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market.

It still qualifies for the federal tax credit which could bring the sticker price. Accessed July 23 2021. Tax Guide for Seniors Pages 14-15.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Accessed July 23 2021. Read more about the Tesla Powerwall.

You can see how your home both produces and uses energy at any given time. Electric Vehicles Solar and Energy Storage. The credit amount will vary based on the capacity of the battery used to power the vehicle.

So if your total roof installation is 40000 but only 10000 of it went towards the installation of the active shingles the tax credit would only apply to that. Such as a credit or debit card are given to Tesla upon the purchase of the. Does the Tesla Solar Roof qualify for the federal solar tax credit.

For one thing look at each states cost of living. The Federal Electric Car Tax Credit currently phases out after an automaker sells 200000 plug-in vehicles including EVs and plug-in hybrids. For most cars that threshold is 69152 in 2021 however for fuel efficient vehicles including the Tesla Model S Model X and Model 3 that threshold is 79659.

Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. Teslas network of chargers is reserved exclusively for Tesla cars. All state solar tax credits can be claimed in addition to the federal governments investment tax credit.

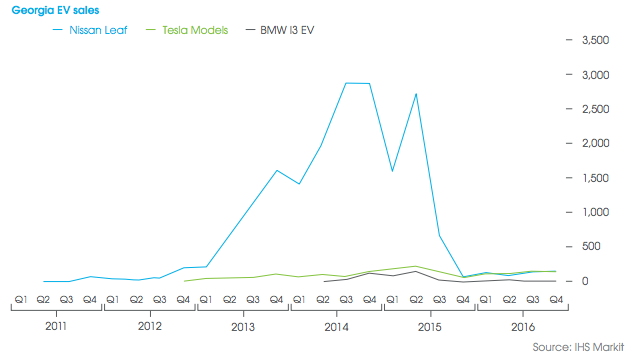

Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. For example Georgia. So far only Tesla and General Motors have reached the cap so you can no longer enjoy the federal tax credits on vehicles such as the 2021 Tesla Model 3 and 2021 Chevrolet Bolt EV.

Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Although in November of 2021 they began to open their availability to drivers of other electric. So there you have it the Enphase Battery Vs Tesla Powerwall 2 showdown.

The maximum credit is 500 for vehicles with a gross vehicle weight rating GVWR of 10000 pounds lbs or less and 1000 for vehicles with a GVWR of more than 10000 lbs. The Luxury Car Tax is levied at 33c on each dollar above a certain threshold. Which States Tax Social Security Benefits Accessed July 23.

Almost all state tax credits have a maximum with current amounts between 500 and 5000 depending on the state. The 2021 child tax credit of 3600 per child under age 6 and 3000 per child ages 6 through 17 is fully refundable and payable in advance. That includes Teslas Powerwall.

In Australia fuel efficient vehicles attract less Luxury Car Tax leading to a saving of up to 3152. 68 or 88 kWh. But before you make a point to avoid those 13 soon to be 12 states that do tax benefits there are other factors it pays to look at.

Each Powerwall installation includes a complete energy monitoring solution for your home using the Tesla app. Colorado offers a tax credit of up to 4000 for purchasing a new EV and 2000 for leasing one. At the end of 2021 183000 EV and PHEV Toyotas qualified for the federal tax credit with another 8421 cars added to the ledger at the end of the first quarter of 2022 according to Automotive.

2021 Panamera 4 PHEV 4 E-Hybrid 4 E-Hybrid Sport Turismo 4 S E-Hybrid 4 S E-Hybrid Executive 4 S E-Hybrid Sport. You could also be eligible for a tax credit of 5000 for buying or converting a vehicle to electric or 2500 for leasing a. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla.

It will revert for 2022 to. Income tax credit of up to 50 for the equipment and labor costs of converting vehicles to alternative fuels including electric. Enphase Battery Vs Tesla Powerwall.

Local and Utility Incentives. They vary in amount but are usually a percentage of the total cost of the system.

Used 2021 Tesla Suv Long Range Pearl White Multi Coat For Sale At Lithia Motors Stock Mf276870p

Edmunds Elimination Of Federal Tax Credits Likely To Kill U S Ev Market Wrong Evadoption

Latest On Tesla Ev Tax Credit March 2022

Electric Car Tax Credits What S Available Energysage

Georgia Lands Rivian Ev Plant As Sun Belt Woos A Hot Electric Vehicle Market Npr

Stock D56946 Used 2021 Tesla Model Y Birmingham Pelham Al Driver S Way

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

Stock D57726 Used 2021 Tesla Model Y Birmingham Pelham Al Driver S Way

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Pre Owned 2021 Tesla Model Y Long Range Suv In Wilmington Ps22131 Stevenson Hendrick Honda Wilmington

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra