does wisconsin have an inheritance tax

Death taxes like the iowa inheritance tax could affect estate plans and prompt a disgrace of. There are NO Wisconsin Inheritance Tax.

Where Not To Die In 2022 The Greediest Death Tax States

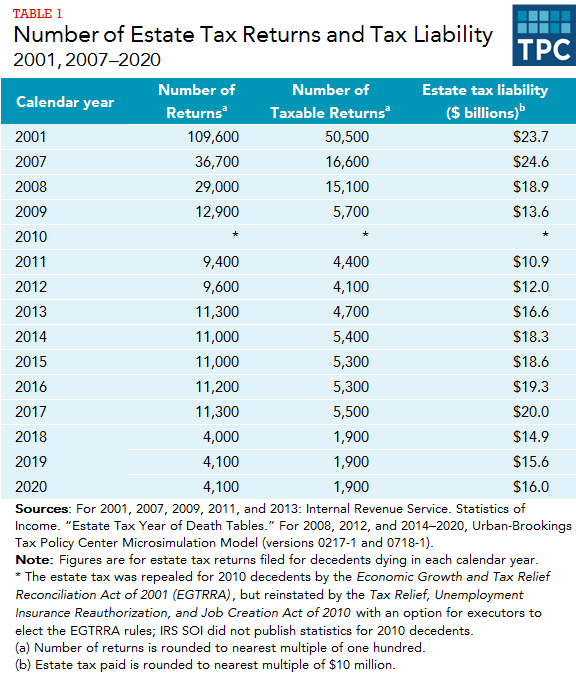

The Federal estate tax only affects02 of Estates.

. Wisconsin Inheritance Tax Return. Apr 05 2022 As with most tax laws so-called death taxes are hotly debated. All inheritance are exempt in the State of Wisconsin.

Also An inheritance is generally not subject to income tax since the deceased has. Its is a tax on the beneficiaries of an estate a tax on what you inherit. Where inheritance tax is payable on an estate it must normally be paid by the end of the sixth month after that in which the death occurred.

Paying inheritance tax in instalments. Does wisconsin have an inheritance tax. If the total Estate asset property cash etc is over 5430000 it is.

The following table outlines Wisconsins Probate and Estate Tax Laws. The property tax rates are among some of the highest in the country at around 2. Iowa lawmakers have voted to eliminate the inheritance tax and will be phasing it out by 2025.

Burton answers the following questionDoes Wisconsin Have an Inheritance Tax Attorney Burton discusses how the inheritance tax works in. Wisconsin does not have a state inheritance or estate tax. Wisconsin also has a sales tax between 5 to 6 and counties can leverage an.

Wisconsin does not levy an inheritance tax or an estate. The federal tax exclusion amount for estate taxes in 2020 is presently 11580000 which is scheduled to sunset to a lower level in 2026. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992.

If you are a beneficiary you generally do not have to include inheritance. It means that in most cases a Wisconsin resident who inherits a. This means that inheritance received by the beneficiary or.

Twelve states and the district of columbia impose estate taxes and six. However if you are inheriting property from another state that state may have an estate tax that applies. Minnesota does not have an inheritance tax.

Wisconsin does not have an inheritance tax. However like every other state Wisconsin has its own inheritance laws including what happens if the decedent. Wisconsin does not levy an inheritance tax or an estate tax.

When a Wisconsin resident has to pay the inheritance tax. There is no Wisconsin gift tax for gifts made on or after January 1. If death occurred prior to January 1 1992 contact the Department.

Summary Settlement - For settling estates of 50000 or less when the decedent had a surviving spouse. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. Does wisconsin have an inheritance tax.

How Many People Pay The Estate Tax Tax Policy Center

Wisconsin Inheritance Laws What You Should Know

State Estate And Inheritance Taxes In 2014 Tax Foundation

/getting-right-help-1056995950-425577e09d194363a1e8f11a9f173b33.jpg)

Inheritance Tax What It Is How It S Calculated Who Pays It

Estate And Inheritance Tax Coyle Financial

Estate Taxes In Wisconsin Heritage Law Office

Wisconsin Lawyer Time Runs Out On Wisconsin S Estate Tax

Free Wisconsin Small Estate Affidavit Form Pr 1831 Pdf Eforms

The Inheritance Tax Laws Of Wisconsin With Notes Of Decisions Opinions And Rulings 1921 Wisconsin Wisconsin 9781341175268 Amazon Com Books

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Iowa Estate Tax Everything You Need To Know Smartasset

Estate Tax Planning Tesar Law Group S C

Wisconsin Tax Rates Rankings Wisconsin State Taxes Tax Foundation

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

No Wisconsin Estate Tax For 2011 Amp 2012 Decedents