lincoln ne sales tax increase

You can print a 725 sales tax table here. The Nebraska state sales and use tax rate is 55 055.

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

The current total local sales tax rate in Lincoln NE is 7250.

. In the event you need to defend your position in the court it may make. Lincolns City sales and use tax rate increase. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

Lincoln is the capital city of the us. This table lists each changed tax jurisdiction the amount of the change. A coalition of community leaders today said a quarter-cent sale tax for streets is needed to keep Lincoln strong and growing.

In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. The minimum combined 2022 sales tax rate for Lincoln Nebraska is. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent.

You can print a 725 sales tax table here. There is no applicable county tax or special tax. The Nebraska state sales and use tax rate is 55 055.

The Nebraska state sales and use tax rate is 55 055. 025 lower than the maximum sales tax in NE. This is the total of state county and city sales tax rates.

The push for raising the local sales tax in Lincoln started when a coalition of 27 community leaders were convened and met for months said Miki Esposito Lincolns public works director. This hotel is located in a city with a 175 city. 025 lower than the maximum sales tax in NE.

The December 2020 total local sales tax rate was also 7250. There are sales tax rates for each state county and city here. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. It was a close vote.

The current state sales and use tax rate is 55 percent so the total sales and use tax rate will. Over the past year there have been 22 local sales tax rate changes in Nebraska. The group is asking the City Council to place on the April 9 primary.

In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. Lincoln Ne Sales Tax Increase. 2022 Nebraska Sales Tax Changes.

The lincoln city council still has to vote on whether to ask voters to raise the sales tax to 175 percent. There is no applicable county tax or special tax. Lincoln voters approved the 14-cent increase in April.

The posted rules should show how you can appeal the countys judgement at the state level if you think it is still incorrect. In April 2015 Lincoln voters approved a 14-cent increase from 15 to 175 in the City sales and use tax to support two important public. What is the sales tax rate in Lincoln Nebraska.

This included the statewide sales tax rate of 55 percent and the additional citywide rate of 15. Leading up to the election the sales tax rate in Lincoln Nebraska was 7 percent.

Nebraska Income Tax Calculator Smartasset

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

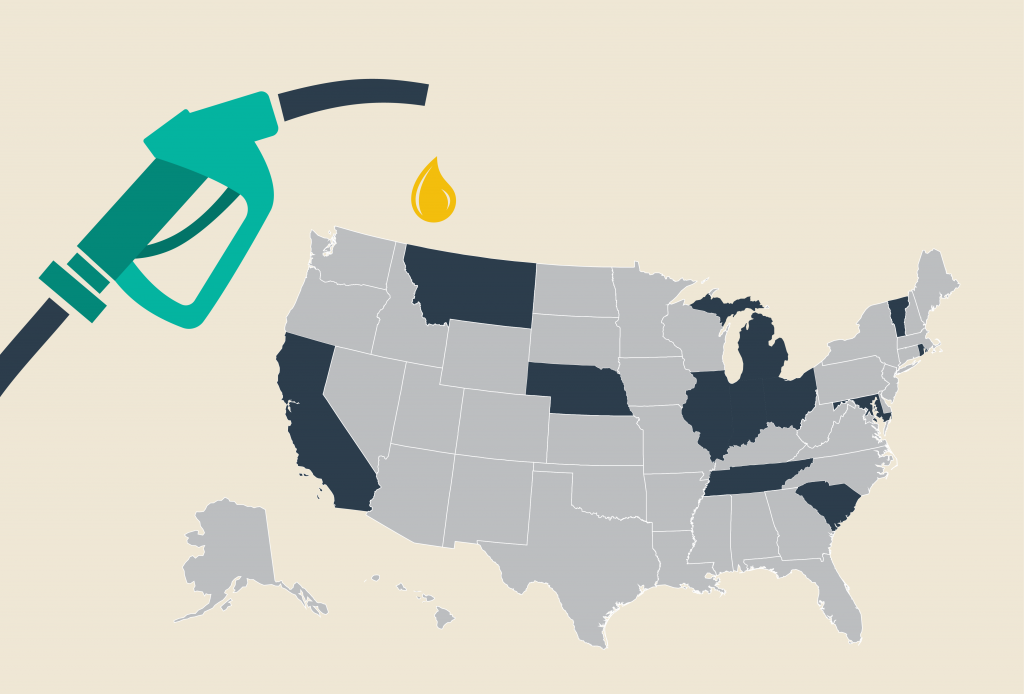

Get Real About Property Taxes 2nd Edition

Illinois Doubled Gas Tax Grows A Little More July 1

What S The Car Sales Tax In Each State Find The Best Car Price

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Rv Rentals Lincoln Nebraska Rent A Camper

Nebraska Sales Tax Small Business Guide Truic

%20(1).png?upscale=True)

Job Opportunities Sorted By Job Title Ascending Job Opportunities City Of Lincoln Lancaster County

Lincoln Voters Approve Quarter Cent Sales Tax For Streets

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

2020 Nebraska Property Tax Issues Agricultural Economics

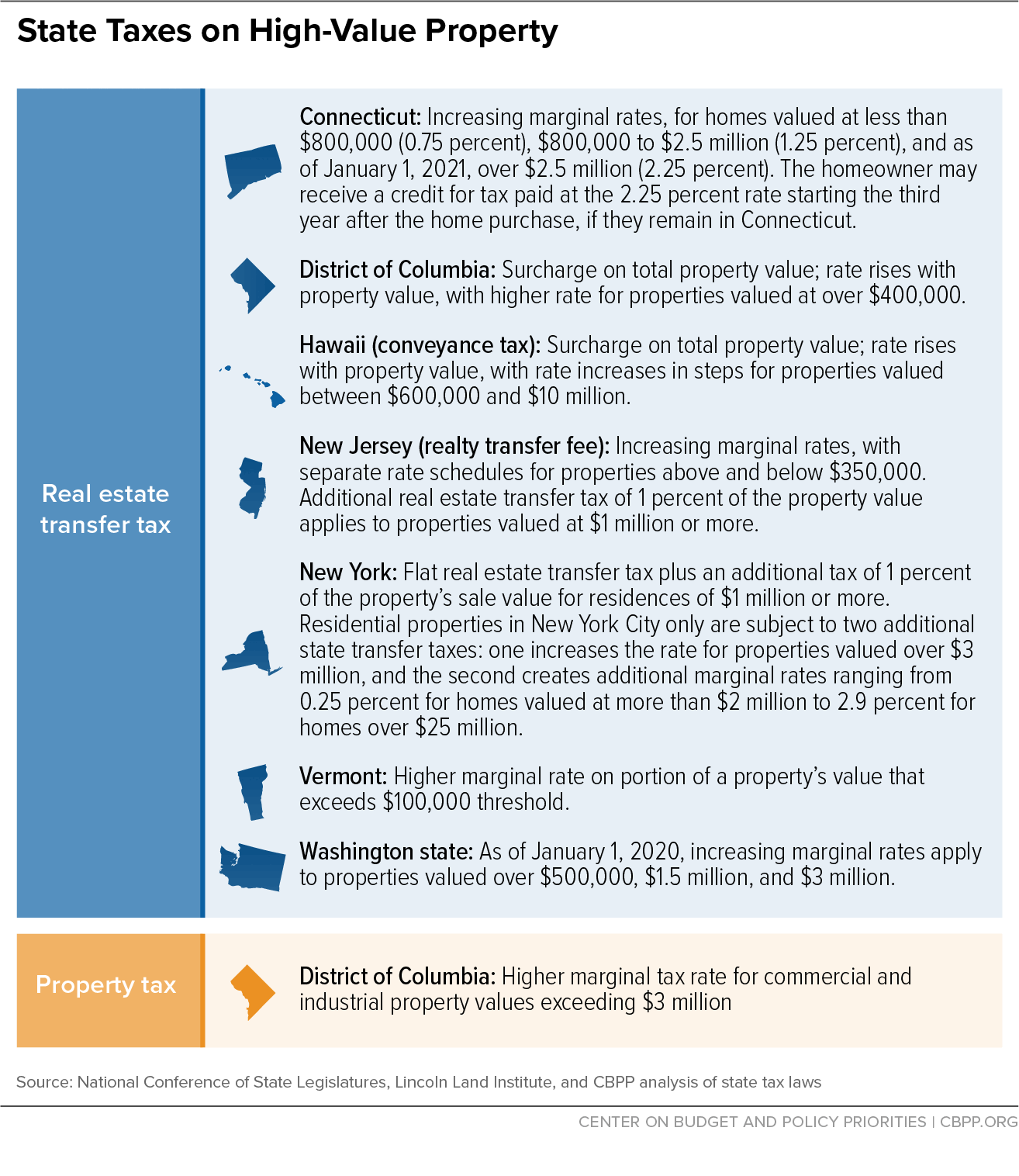

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities